Navigating Healthcare: Get Compare Rates Quotes and Save Money $500 Today

Navigating Healthcare: The Top 7 Best Health Insurance Options for Senior Citizens elderly 55 and Older

As people transition into their golden years, ensuring get right of entry to to high-quality healthcare will become more and more crucial.

For the ones elderly fifty five and older, choosing the right health insurance plan can notably effect their nicely-being and financial safety. In this comprehensive manual, we're going to discover the pinnacle seven health insurance alternatives tailored to satisfy the particular wishes of senior residents.

1. Medicare

Medicare stands as a cornerstone of healthcare insurance for Americans elderly 65 and older. This federal medical health insurance over 65 age affords important coverage for medical institution stays (Medicare Part A) and clinical offerings (Medicare Part B).

Additionally, seniors have the option to sign up for Medicare Part D for prescription drug insurance and may pick out to complement their coverage with a Medicare Supplement Insurance plan (Medigap). Medicare gives comprehensive insurance and versatility, making it an super option for plenty seniors.

2. Medicare Advantage (Part C)

Medicare Advantage plans, also referred to as Medicare Part C, provide an opportunity to standard Medicare by using presenting insurance via non-public insurance agencies.

These plans regularly consist of additional benefits inclusive of imaginative and prescient, dental, and prescription drug insurance, which may not be included beneath original Medicare. Medicare Advantage plans can provide cost savings and convenience for seniors who decide on a single, bundled plan for their healthcare desires.

3. Medicaid

Medicaid is a joint federal and country application that offers health insurance to low-profits individuals, which includes seniors with confined financial resources.

Eligibility necessities range by way of nation, however Medicaid might also cover a extensive range of healthcare offerings, together with health practitioner visits, sanatorium stays, long-time period care, and more.

Seniors aged fifty five and older who meet profits and asset criteria can also qualify for Medicaid advantages, presenting get admission to to important healthcare services at little to no value.

4. Employer-Sponsored Coverage

Some seniors aged 55 and older may nevertheless be running and eligible for agency-subsidized medical insurance coverage.

Employer plans often offer comprehensive advantages, together with scientific, dental, and vision insurance. Additionally, organization-sponsored plans might also offer subsidies or contributions closer to premiums, making them an attractive option for seniors who're nonetheless inside the staff.

5. Veterans Health Administration (VA) Benefits

Seniors who have served within the military can be eligible for fitness advantages via the Veterans Health Administration (VA). VA blessings include access to complete healthcare offerings, including number one care, distinctiveness care, mental fitness services, and prescription drugs.

Additionally, veterans can also acquire insurance for carrier-connected disabilities and long-time period care offerings, making VA blessings a precious option for senior residents with navy provider revel in.

6. Affordable Care Act (ACA) Marketplace Plans

While Medicare is the primary supply of health insurance for seniors aged sixty five and older, the ones beneath sixty five may discover medical insurance options through the Affordable Care Act (ACA) market.

ACA plans provide complete coverage, along with critical health blessings which include preventive care, prescribed drugs, and intellectual health services.

Subsidies may be to be had to help lower rates and out-of-pocket fees for eligible people, making ACA marketplace plans a viable alternative AARP insurance for seniors elderly 55 and older who do now not but qualify for Medicare.

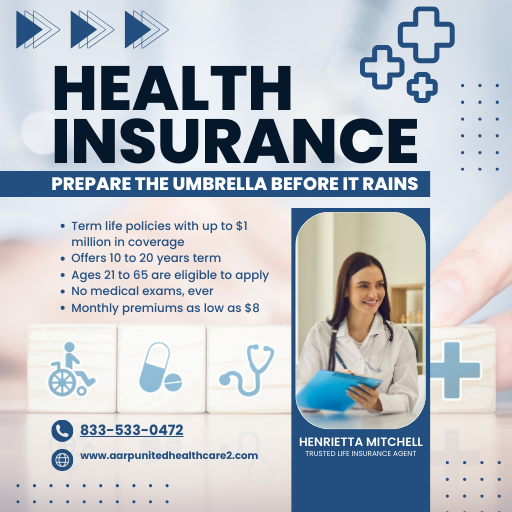

7. Private Health Insurance Plans

For seniors elderly 55 and older who do not qualify for Medicare, Medicaid, or different government-backed applications, non-public medical insurance plans may be available via insurers or healthcare exchanges.

These plans vary in insurance and fee, so it is essential to cautiously compare alternatives and take into account elements consisting of rates, deductibles, and network insurance earlier than deciding on a plan.

Read More - AARP Health Insurance Rates Age 62 to 65

Private health insurance plans offer flexibility and choice, allowing seniors to tailor insurance to their unique healthcare needs.

Conclusion

In end, selecting the right health insurance plan is a critical choice for senior residents elderly 55 and older. With lots of options to be had, such as Medicare, Medicaid, organization-backed coverage, and personal insurance plans, seniors have the possibility to find a plan that meets their precise healthcare desires and budgetary issues.

Read more about Burial Insurance for Seniors No Waiting Period

By know-how the features and advantages of each option and punctiliously evaluating their character circumstances, seniors could make an informed decision to make sure get entry to to pleasant healthcare and peace of thoughts of their retirement years.

Ready to secure the best health insurance plan for your needs as a senior citizen aged 55 and older?

Explore your options today and ensure you have the coverage you deserve for a healthy and fulfilling retirement.

Don't wait - take control of your healthcare journey now! Follow us on Facebook

Privacy Policy | Disclaimer | TERMS OF USE

Copyright © Health Insurance 2024